Dynamic Asset Allocation Explained

We know from academic research that dynamic asset allocation is the gold standard in wealth management. But what exactly is it and how is it used in goal-based.investments?

What is a Dynamic Asset Allocation?

A dynamic asset allocation is an approach to investing where your portfolio allocation evolves over time based on your risk tolerance, your investment priorities, market conditions, and progress toward your financial goal. Unlike static strategies, it adjusts your investments to better navigate market fluctuations and maximize the likelihood of achieving your objectives.

Dynamic Asset Allocation vs. Buy-and-Hold

Why consider a dynamic asset allocation instead of sticking to a straightforward buy-and-hold approach? Let’s explore two scenarios where a dynamic allocation could have yielded better outcomes.

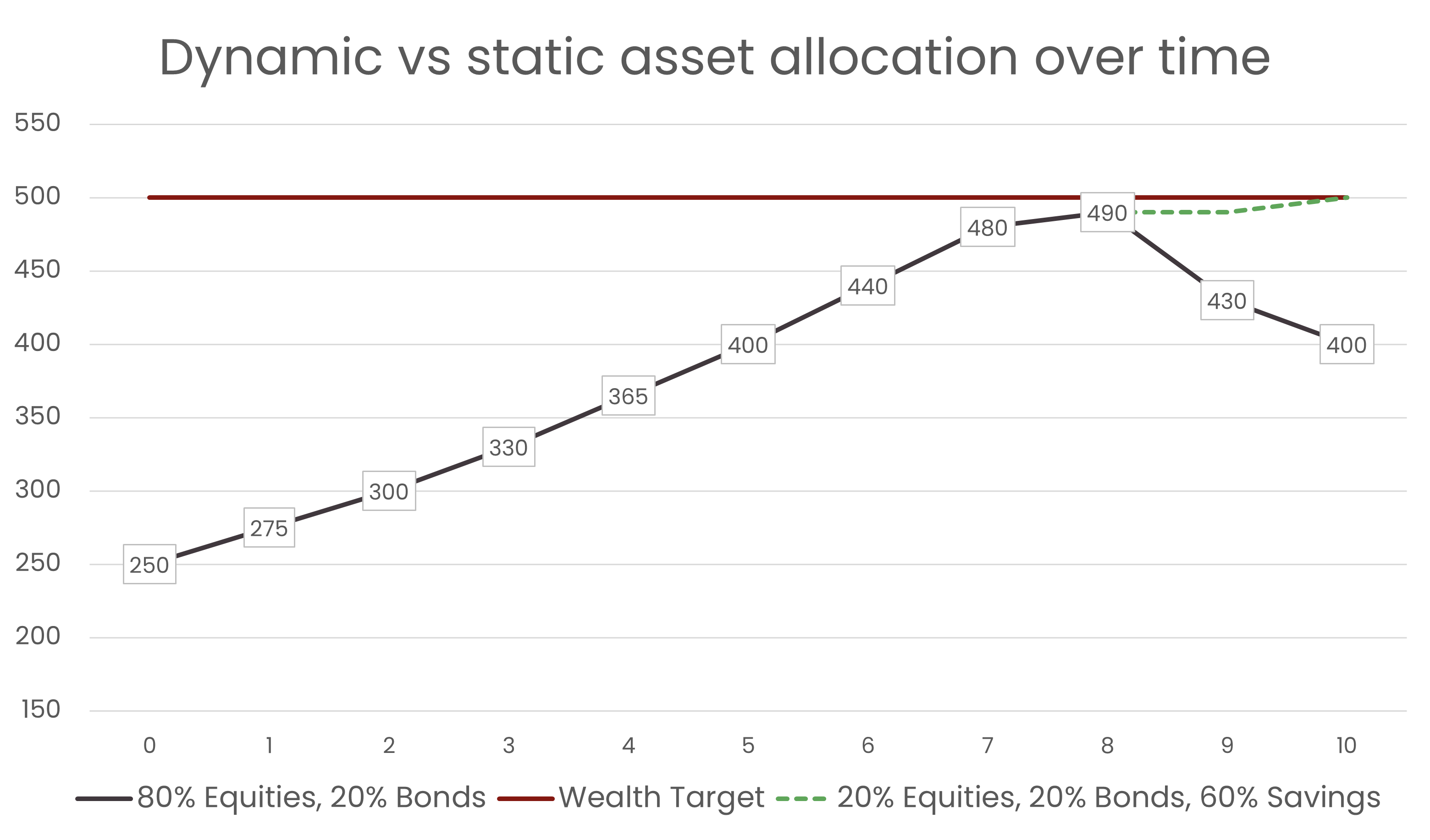

► Example 1: Missed Goal Due to Lack of De-risking

Imagine you’re saving for a $500,000 house in 10 years. You start with $250,000 and opt for an aggressive 80-20 portfolio (80% equity, 20% fixed income). After eight years, strong market performance has grown your investment to $490,000—just $10,000 shy of your goal. But you stick with the 80-20 portfolio, and unfortunately, market downturns in the final two years reduce your capital to $400,000. You fall short of your target.

What could have been done differently? With only $10,000 left to reach your goal, a dynamic allocation would have shifted your portfolio to a more conservative allocation, mitigating the impact of market volatility and securing your objective.

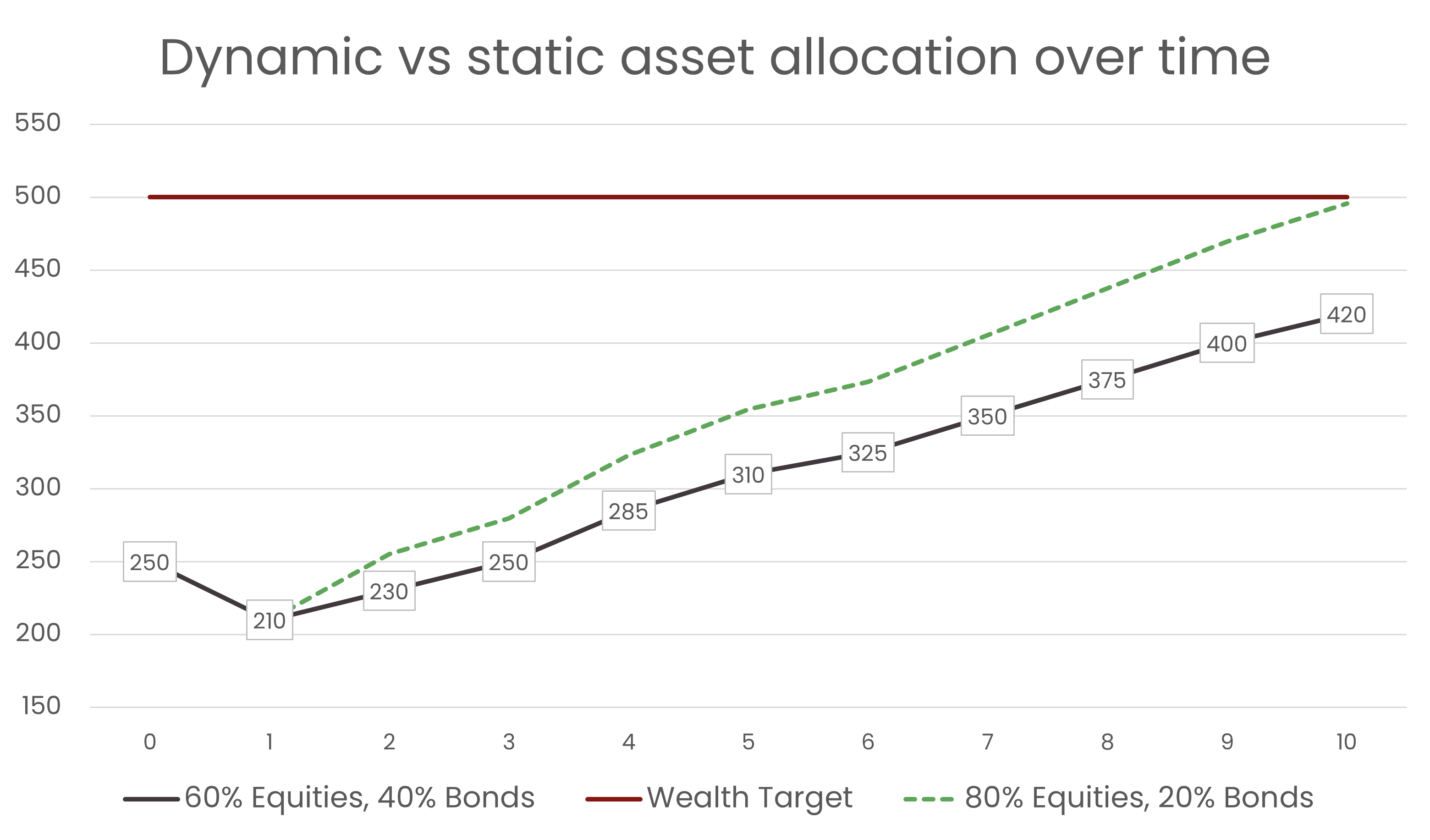

► Example 2: Missed Goal Due to Lack of Risk Adjustment

Now, consider the same goal and starting point. This time, despite a capability for higher risk, you choose a conservative 40-60 portfolio (40% equity, 60% fixed income), expecting steady growth to reach $500,000. But market returns underperform in the first two years, leaving your investment at $230,000—lower than your starting amount. Despite a recovery over the remaining eight years, your final portfolio value is $420,000, still short of your target.

What could have been done differently? A dynamic allocation would have recognized the need for a higher-risk allocation after the initial setback, giving your portfolio a chance to rebound and achieve the desired growth by the end of the 10 years.

Conclusion: The Flexibility of Dynamic Allocations

A buy-and-hold strategy relies on fixed assumptions and does not adapt to changing market conditions or proximity to your goal, which can result in missed targets. In contrast, a dynamic asset allocation offers the flexibility to adjust allocations based on your evolving circumstances. This adaptability increases your chances of achieving your financial objectives.

Curious about how to select the best dynamic asset allocation? Learn how dynamic programming can optimize your investments and bring peace of mind in our next article. Subscribe to our blog and stay tuned!