From Beginner to Investor in Just 5 Days

Many delay investing because it feels too complex or risky. Our 5-day program combines knowledge, strategy, and guided action so you can start with confidence.

The First Important Steps – Your Path in Just 5 Days

Our Do-It-Yourself Investors Program

Investing. Few topics spark as much hope and fear at the same time. Many people feel the urge to finally do something with their money, while at the same time feeling uncertain: With all the stock market records, isn’t it already too late to start? Isn’t investing far too complicated or risky? And where should you even begin, when everyone else seems to have already rushed ahead?

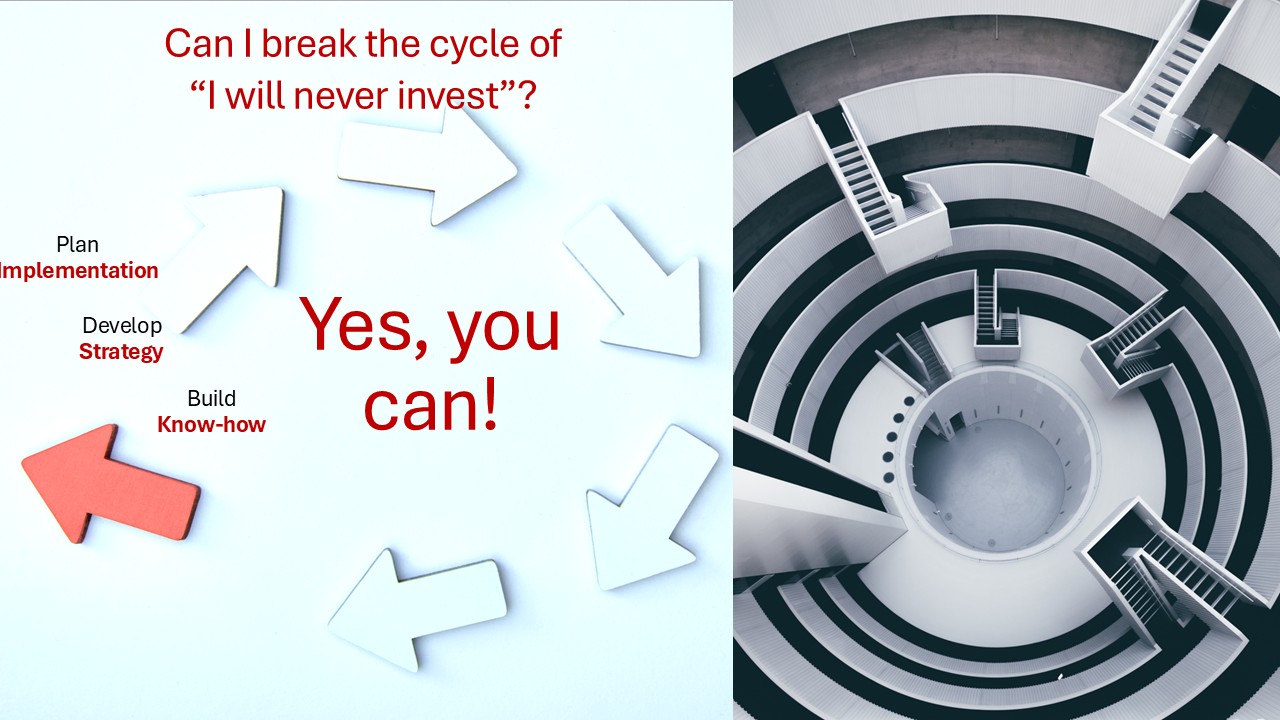

These doubts lead to the topic being postponed again and again. You know you should act, but it just feels overwhelming. We call this the investment inertia trap – and it is the most common reason why people never take the first step.

Why Most People Fail: Three Hurdles Holding You Back

Over the past years, we have guided hundreds of people and noticed that the obstacles are almost always the same: lack of know-how, no clear strategy, and uncertainty in execution. These three factors decide whether your money will work successfully for you – or whether you will look back after years, frustrated, realizing you missed opportunities.

1. KNOW-HOW ► THE FEELING OF NOT UNDERSTANDING

Many start like Laura. She eagerly bought a book about investing, wanting to finally understand how stocks and ETFs work. But after the first chapters, she was frustrated. Terms like TER, rebalancing, hedged, or diversification felt like a foreign language. An online course was supposed to help, but after two sessions life got in the way, motivation was gone – and the investment plan was shelved. This pattern is typical: either you get lost in endless research on YouTube and blogs, without knowing if the information is reliable, or you are left alone with unanswered questions. In the end, you retain lots of knowledge, but never move to concrete action.

2. STRATEGY ► MANY PATHS, BUT NONE LEAD TO THE GOAL

Even if you acquire knowledge, the big question remains: Which strategy really suits me? Judith trusted her bank advisor, Giovanni tried self-trading, Marie relied on a modern robo-platform. All three experienced setbacks. Judith ended up with 23 different products in her portfolio but no real wealth growth. Giovanni lost money with risky trades and currency fluctuations. Marie started with a pillar 3a savings plan through a robo-solution that sounded professional but ended up losing almost 20% in one year because the strategy did not match her risk profile. This shows: without a personal, clearly structured strategy, you quickly get lost – and pay in the end with unnecessary risks or costs.

3. IMPLEMENTATION ► THE FINAL HURDLE

And even when knowledge and strategy are in place, many fail at implementation. You have to choose an online broker, open an account, set up a savings plan with the right ETFs. What sounds simple in theory suddenly feels complicated in practice. Many hesitate at the final click, are afraid of making mistakes, or let emotions guide them. Typical errors include unnecessarily high costs, hidden fees, or impulsive decisions. Without clear structure and guidance, the last step often remains undone – and the money continues to sit unused in the savings account.

The Solution: Knowledge + Strategy + Implementation in Just 5 Days

This is exactly where the DIY Investors Program comes in. In just five evenings of 2.5 hours each, you will learn everything you need to invest your money independently and with confidence. What’s special: we guide you step by step through the entire process – from basic knowledge, to your personal strategy, to implementation with the broker of your choice.

The journey begins with Day 1 and 2, where you understand why investing works, what asset classes exist, and how to avoid common pitfalls. On Day 3 you will build your strategy foundation, including a DNA test for your personal risk profile. On Day 4 you will gain access to our robo-advisor tool that creates your individual roadmap – including a PDF that documents your strategy in black and white. And on Day 5 it’s all about implementation: with checklists, broker guides, and our support you open your first account, set up your ETF savings plan or your pillar 3a investment.

Our Promise: You Won’t Be Left Alone

Many courses end as soon as the last lesson is over. Our approach is different. We continue to support you even after the program is finished, so that you really stay on track in the long term. After six months we check together if your strategy still fits, if you are comfortable with your risk, and if your expectations are being met. After twelve months a second review follows, where you will understand your performance and can clarify any open questions. This way we make sure that you not only start, but also remain successful in the long run.

WHY IT PAYS OFF RIGHT NOW

The next course runs from September 22 to 26, 2025. Seats are strictly limited – only ten spots are available, so that we can personally support each participant with implementation. Anyone who registers now also secures access to all future additional features. And if you are not satisfied in the end, our money-back guarantee applies – no ifs or buts.

Conclusion: From Beginner to Investor in Just 5 Days 🚀

Investing does not have to be complicated or intimidating. If you have the right knowledge, develop a personal strategy, and take your first steps with support, you can gain control over your finances in no time. The DIY Investors Program gives you exactly this structure and confidence. With a clear implementation guarantee and continued support even after the course.

Now is the right time to break free from the inertia trap and make your money work for you. Join our DIY Investors Program.