How much investment risk can I take as investor

The most common mistake first-time investors make is overestimating their ability to handle financial market risk. It is therefore important to honestly assess your personal risk profile.

Assessing Risk Tolerance and Capacity

One of the biggest pitfalls for first time investors

The most common mistake first-time investors make is overestimating their ability to handle financial market risk. Therefore, an essential step in goals-based investing is to honestly assess your personal risk profile, which primarily (but not exclusively) consists of your risk tolerance and risk capacity.

Risk capacity is your ability to withstand financial risk/uncertainty and it is based on factors such as your income, age, savings, debts, and obligations to others. It basically defines how deep your pockets are and how well you can weather financial storms.

The second important element of your risk profile is your personal risk tolerance. Risk tolerance refers to your psychological comfort level with investment volatility and potential loss. It is often referred to as your personal attitude toward risk. It seeks to answer the question: "How much risk (i.e., financial potential for loss) are you willing to take in order to achieve a goal?

THIS IS AS FAR AS THE STANDARD PRACTICE WILL GO

Understanding your innate risk preferences separate from your situational risk capacity allows usually financial advisors to make for you informed tradeoffs between risk and return when investing. Those with a higher tolerance and capacity are offered higher expected returns through riskier assets like stocks. Advice for more conservative investors with lower risk appetite and capacity will be tilted towards a less risky asset allocation including savings or other liquid assets like bonds.

This is how the industry has operated for the past several decades, and this is how it has failed to protect clients from taking on too much risk. As numerous academic publications have shown, investors overestimate their ability to withstand financial turmoil, with disastrous results.

BUT THIS WILL CERTAINLY NOT BE ENOUGH

As soon as the first major market turbulence hits the investment account, investors experience their true risk appetite and ability to take financial risks, with the usual result that risks are reduced or, in the worst case, eliminated at the worst possible time.

A new gold-standard for goal-based investors

At goal-based.investments, we take a more rigorous approach to assessing an investor's ability to manage risk. Our Investment Suitability Framework (ISF) consists of three main elements and is designed to enhance the traditional Investor Risk Profile (IRP).

► Pillar 1: What kind of risk is needed?

By defining the investment category aspired (reach goal, pay back debt, etc) and goal (e.g. pay back a fixed rate mortgage) we can apply surplus optimization to specifically account for the goal nature and hence the appropriate market risk needed.

► Pillar 2: How much risk is acceptable?

Risk capacity and tolerance help establish a preliminary Risk Score (RS). Behavioral risk factors such as loss tolerance and personal risk preferences are added to this score. To ensure that investors with high risk scores cannot take on extremely high risk without demonstrating financial sophistication, we add a know-how score to the equation as a soft penalty. And to be on the safe side, we only give investors a high risk profile score if they have confirmed their inputs with two tests.

The result of this process allows us to derive the maximum possible risk for each investment strategy and objective, and to define the acceptable range of portfolio strategies.

► Pillar 3: How much risk is appropriate?

Finally, we must consider the priority of the investment objective. The importance or impact on the individual's financial well-being if the goal is not achieved is important. An investor with deep pockets and a high capacity for financial risk should not use that capacity if the outcome of not achieving the goal is extremely unfortunate for him or her.

Less is more - better safe than sorry

This further narrows the investment universe by taking into account the required probabilities of success, thereby narrowing the acceptable range of portfolio strategies to what we call an appropriate portfolio strategy.

Our investment suitability framework that includes establishing an individual risk profile score can be described simply as:

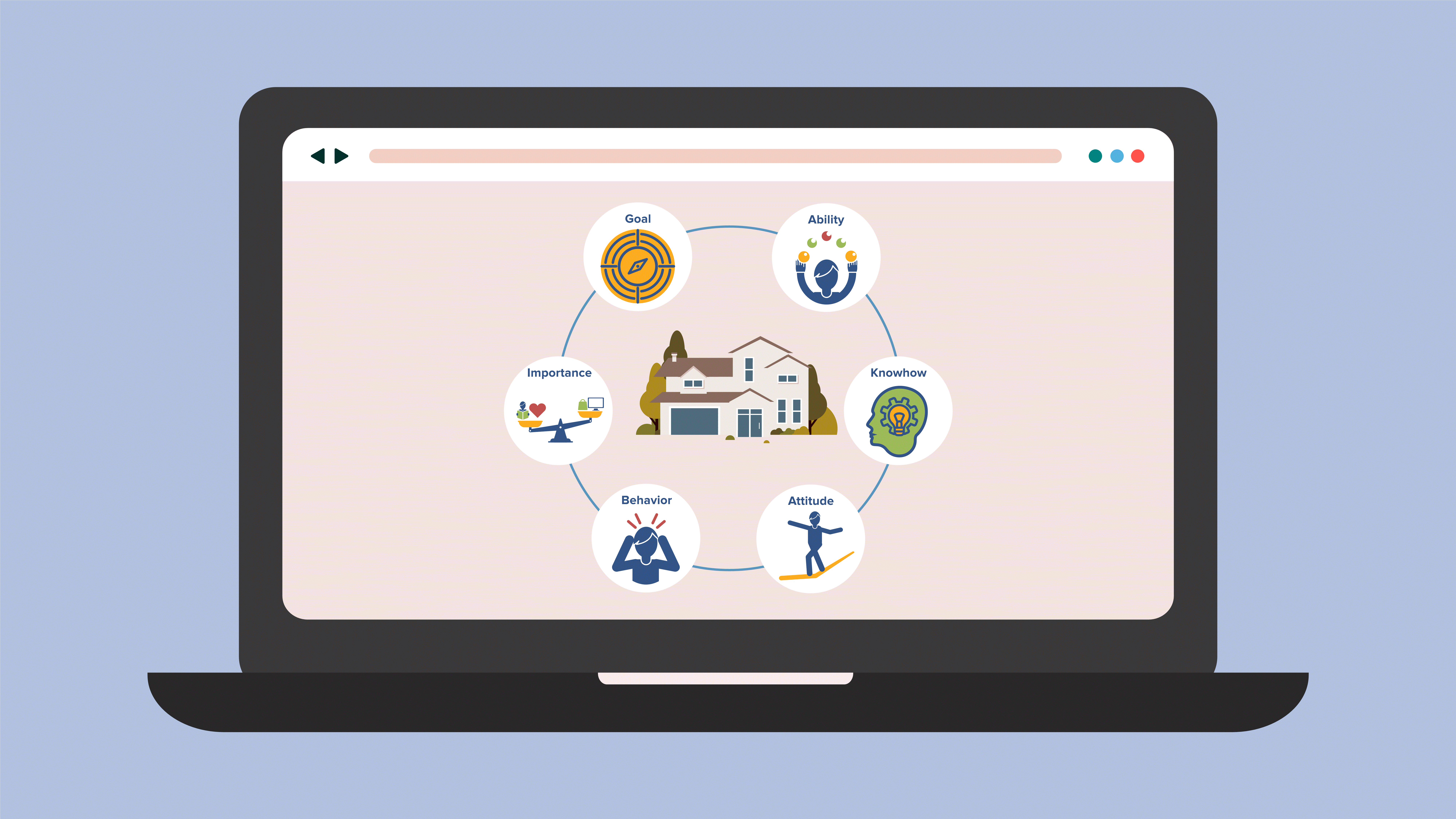

goal nature + ability + knowhow + attitude + behavior + importance = investment strategy

We see it as our key differentiation factor to allow investors to experience first low risk investments before the move, with evolving wealth towards a higher risk score.

And a last but important word of caution

Your risk preferences and capacity will be used by your financial advisor to determine appropriate investment strategies for each goal. Do not allow financial advisors to use a possible long investment horizon as reason to recommend you more risk. This is ill-advised! We, along with many academics, do not believe in “time diversification”. Unfortunately, advisors use long investment horizons to sell higher-risk, higher-margin products. Don't buy into it. Your risk profile is the same regardless of your investment horizon.

Be honest about your ability to endure potential volatility. Re-evaluate your risk posture periodically as life situations and market conditions evolve. With the right understanding of risk, goal-based investing allows aligning investments to your personal risk appetite.