Understanding Investment Fees

Fees and knowhow is what stands between you and your future wealth

We believe that fees, along with financial literacy, are the biggest barriers to accessing capital markets for individual investors. Unfortunately, fees are often hidden or mixed in with performance figures, making it difficult to fully understand their impact on your assets. That is why we have created a tool that helps you uncover the hidden costs of your "managed" investments by comparing their 5-year performance with a solution you can implement yourself.

Select a top-of-mind portfolio

and compare your wealth before and after fees

Important note: Past performance is no guarantee of future performance. The historical analysis provided here is for illustrative purposes only and can only partially illustrate the risk associated with an investment in the capital markets, which may result in the loss of your invested capital.

The various types of investment fees

...that cannibalize your wealth

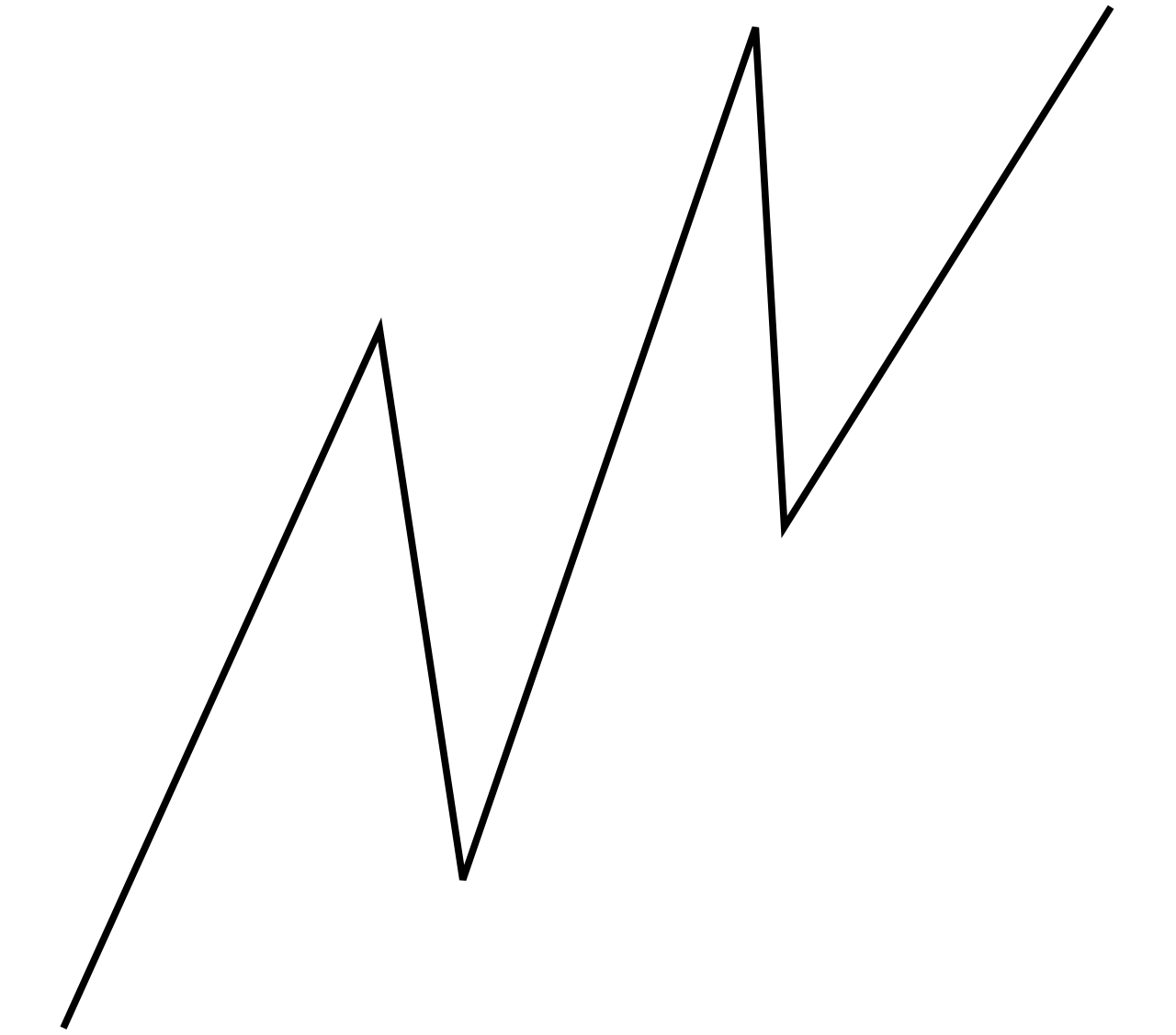

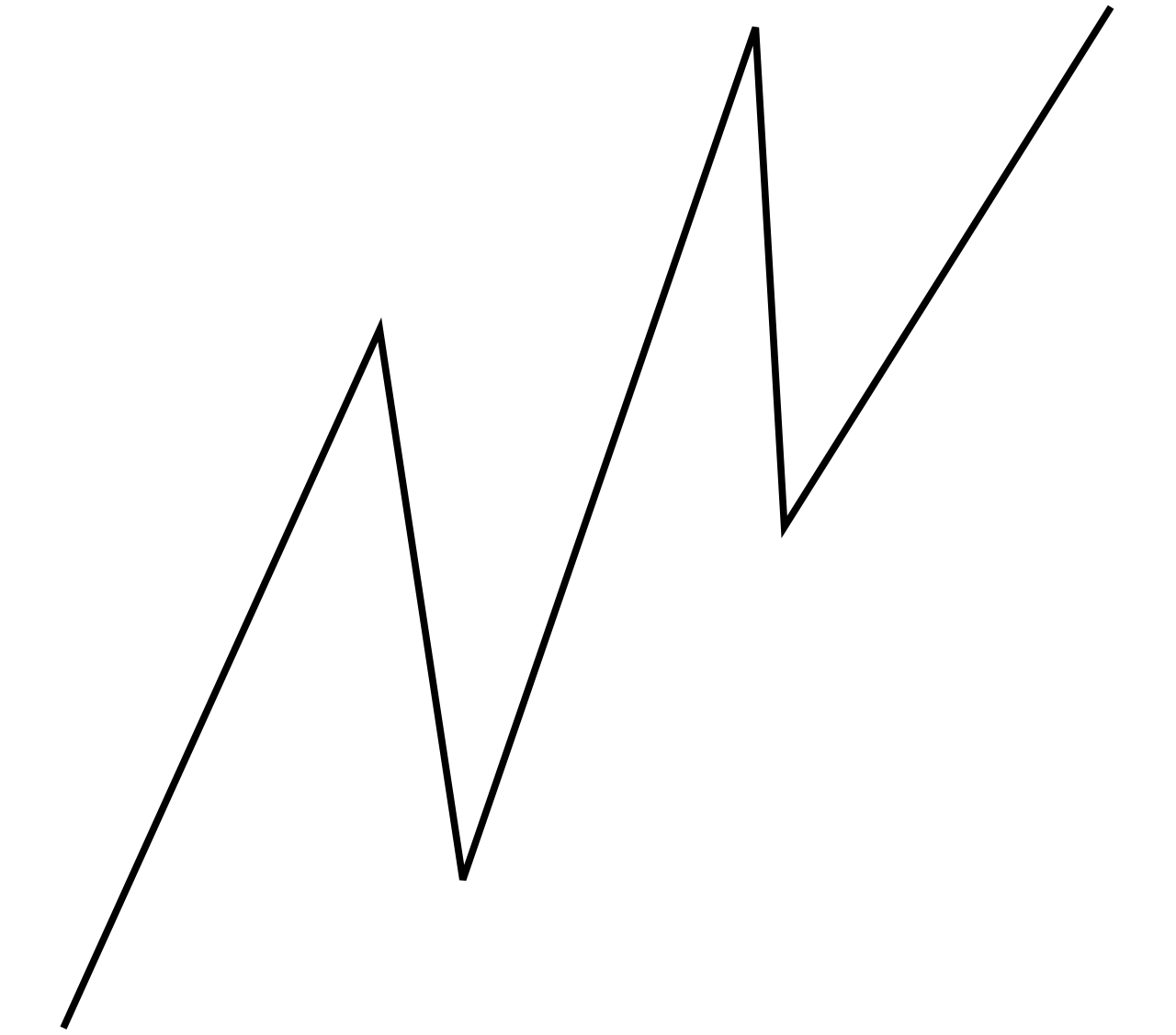

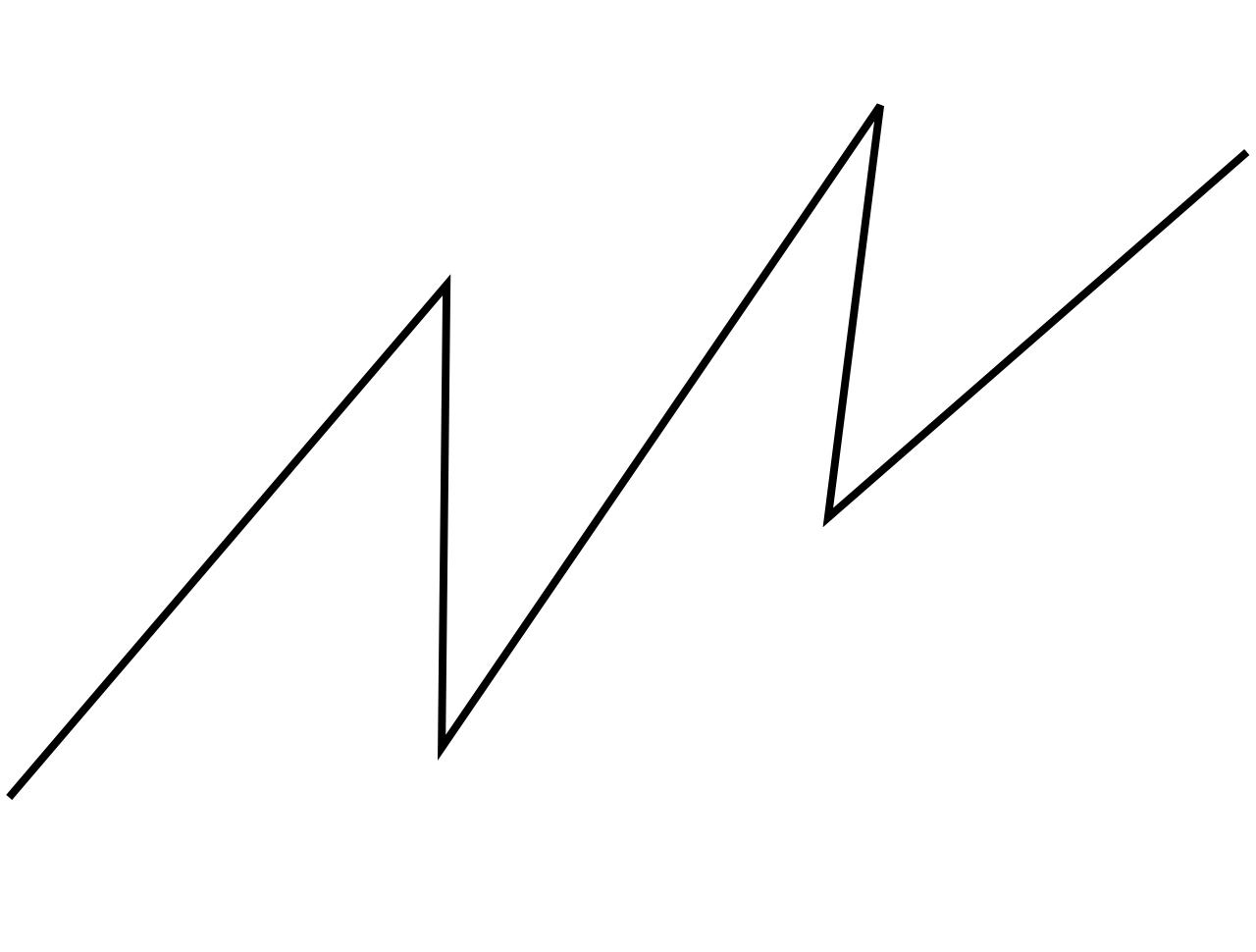

Investment fees can be split into reported and unreported (i.e. hidden) fees. Both represent opportunity costs since they reduce the potential of growing your wealth over time. Understanding fees it hence the first step to avoid them!

~ In Switzerland

~ 0.75% to 3% or more

~ In Switzerland ~ 0.75% to 3% or more = your cost saving potential

= your cost saving potential

Gross performance without hidden costs

Soft (dollar) costs

The cost of executing trades with associated brokers/dealers for soft compensation

An asset management or wealth management unit that executes its trades with an associated trading desk (e.g. from a parent company) and receives services or other indirect compensation is collecting soft dollars. Soft dollar agreements become a cost factor if the executed trades are being settled at a higher price than otherwise observed in markets. The possibility of hiding these costs is particularly elevated with OTC (over-the-counter) transactions.

Soft costs

Cost of executing trades with associated brokers/dealers for soft (i.e. unreported) compensation

Cash drag

The costs of having an inefficient strategic asset allocation

Cash positions that are being held for trading and hedging purposes instead of asset allocation purposes represent a cost factor since cash is not premium bearing asset class. The higher the number of assets in a portfolio is, the higher is usually the cash drag due to trading / rebalancing and hedging.

Cash drag

The costs of intentionally imposing an inefficient strategic asset allocation to serve own business and not the client

Gross performance of investment strategy

Depository fee

The costs of holding your assets in a securities account

Your purchased securities / investment products need to be booked and stored in an securities account. The bank or broker you select will usually charge you a fixed annual fee for offering this service

Deposit fees

Costs of holding your assets in a securities account

Remedy: use discount broker with attractive cost structure, avoid intransparent "all inclusive" structures

Trading and transaction fees

The costs of executing our investments

When you buy or sell ain investment product you will usually pay a higher price for buying and receive a lower price for selling your investment. This difference is called the bid-offer spread. If your product is not traded on a stock exchange like mutual funds, you often pay an initial purchase or redemption fee instead

In addition, when placing your order, often a fixed order fee is additionally charged.

Trading fees

Costs associated with your investment product

Remedy: select cost efficient ETFs with low expense ratio, avoid mutual funds, hedge funds and star investors

Costs of buying and selling the investment product

Remedy: invest in few instrument traded at exchanges, ovoid large portfolios & structured products

(Total) Expense ratio

Is the cost associated with your investment product (product fee)

When purchasing a mutual fund, ETF or index fund, the company providing the instrument vehicle will charge a fee for its service. These expenses are usually deducted from your investment returns and reported as fraction (expense ratio). So what you see as product performance is already net of costs.

Product fees

Investment management fees

Is the cost associated with managing your wealth

If you are handing over the management of your wealth to a third party (wealth management- or advisory mandate) you will usually pay a percentage fee of your total wealth for managing your assets.

This fee is often charged quarterly and deducted from your investments. In Switzerland investment management fees of 1% or more are not uncommon

Investment management fees

Cost associated with someone managing your wealth

THIS IS THE ELEPHANT IN THE ROOM.

Remedy: Avoid handing over the your wealth to fee maximizing institutions and learn how to manage your wealth on your own. You can do it!

Net performance of investment strategy left after fees

It all lies with you!

It is an effort you have to take but...

...the numbers speak for themself. The money that can be preserved when managing your own wealth is absolutely significant and we encourage you to get started investing on your own to avoid all the hidden and less hidden fees that over time make a big difference on how much you can grow your wealth. Here's how: Using the Roboadvisor in five steps.